|

|

Post by dappy on Nov 1, 2024 11:50:15 GMT

Ok. I am with respect seeing fine words but no solutions. It seems you are rejecting increased tax and increased borrowing, so I presume you advocate cutting public services very substantially. What is to be cut?

|

|

Steve

Hero Protagonist

Posts: 3,633

|

Post by Steve on Nov 1, 2024 13:41:54 GMT

Ok. I am with respect seeing fine words but no solutions. It seems you are rejecting increased tax and increased borrowing, so I presume you advocate cutting public services very substantially. What is to be cut? I am rejecting increasing tax on providing jobs But we have to increase tax, I've consistently argued for that. Tax consumption of non essentials, capital gains and wealth. |

|

|

|

Post by dappy on Nov 1, 2024 15:16:33 GMT

Capital Gains doesn’t raise much. About £15bn. A balance has to be found so that it doesn’t stifle innovation and investment. They upped the rate in the budget but there’s a limit before it becomes counter productive. It’s part of the solution but only a limited bit.

Wealth taxes sound great but the experience of other European countries who have tried them and largely given up on them suggests that mining that seam doesn’t really work.

|

|

Steve

Hero Protagonist

Posts: 3,633

|

Post by Steve on Nov 1, 2024 15:56:24 GMT

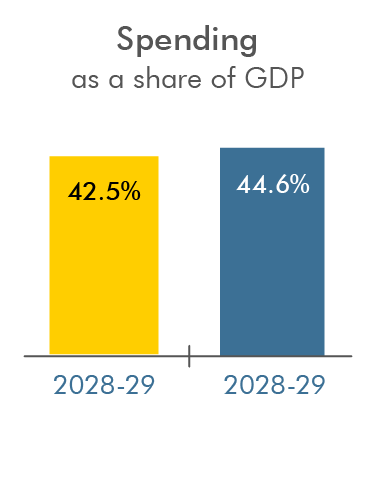

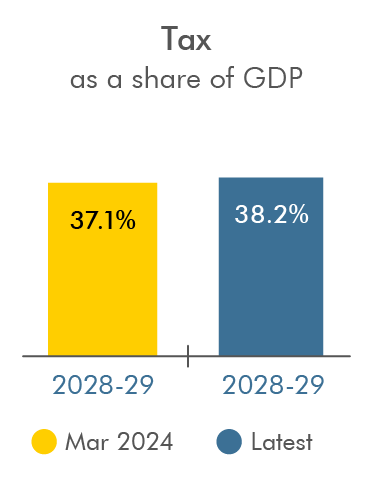

Capital Gains doesn’t raise much. About £15bn. A balance has to be found so that it doesn’t stifle innovation and investment. They upped the rate in the budget but there’s a limit before it becomes counter productive. It’s part of the solution but only a limited bit. Wealth taxes sound great but the experience of other European countries who have tried them and largely given up on them suggests that mining that seam doesn’t really work. France overcooked it, took it well beyond the Laffer curve point so as you say it was self defeating - especially when it was so easy for rich French families to just move to Belgium etc. Our property taxes are ~0.6% on the first £700k of value then nothing on the rest. In the USA you can easily be paying 3 times that with no cap, in France even after they scaled back it can easily be 5 times and again uncapped. A big part of the value of property/wealth taxes is they establish a moral 'look we're really in this altogether' basis for increasing taxes the normal folk pay. IMHO there's a strong argument for ending employees NI by rolling it into a 30% standard rate of tax. That would not raise anything more from the working age population but the better off pensioners very much would pay more. But then again no party likes to offend the silver haired vote. But if we're spending 44.6% of GDP on the services etc we collectively demand then we need to be taxing North of 42% |

|

|

|

Post by dappy on Nov 1, 2024 17:43:29 GMT

I assume you mean basic rate and still retain a higher rate for higher earners. If so there is a theoretical case for merging PAYE and NI. Loads of complex issues to iron out however and realistically any government trying to do this would get slaughtered, just note the furore over the entirely sensible WFA. Really not worth going there.

Which is why I think the budget was a decent effort within the boundaries of political reality.

|

|

Steve

Hero Protagonist

Posts: 3,633

|

Post by Steve on Nov 1, 2024 19:58:22 GMT

I agree with everything but your last sentence. She's attacked jobs and attacked the already in serious pressure GP surgeries and hospices.

|

|

|

|

Post by Zany on Nov 1, 2024 20:59:56 GMT

Capital Gains doesn’t raise much. About £15bn. A balance has to be found so that it doesn’t stifle innovation and investment. They upped the rate in the budget but there’s a limit before it becomes counter productive. It’s part of the solution but only a limited bit. Wealth taxes sound great but the experience of other European countries who have tried them and largely given up on them suggests that mining that seam doesn’t really work. Feels to me like those really in charge ensure it never happens |

|

|

|

Post by Zany on Nov 2, 2024 8:34:05 GMT

The OBR may have substantially endorsed the 'Tories left us a hidden black hole' argument but they are hardly enthusiatic about things. obr.uk/

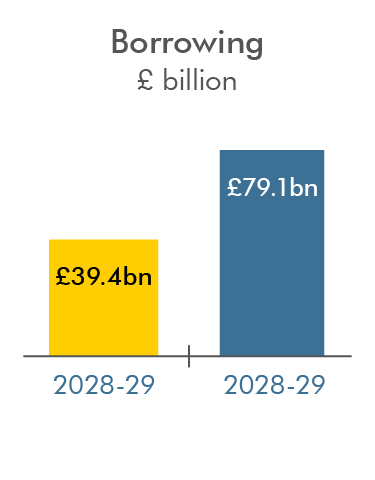

'Budget delivers large increases in spending, tax, and borrowing

The Budget increases spending by £70 billion annually, with two-thirds on current and one-third on capital spending. Half is funded through tax increases which raise £36 billion annually and push the tax take to a record 38 per cent of GDP. The rest is funded by £32 billion more borrowing annually which temporarily boosts GDP growth to 2 per cent in 2026, but leaves output unchanged in the medium term. New fiscal rules, to balance the current budget and get net financial liabilities falling relative to GDP in five years, are met by small margins of £10 and 16 billion respectively.'   Tax to GDP in the EU is 40%. Mortgage rates have not risen. Bond yields rose by 0.3% that's hardly going to effect mortgage rates. They rose by 5 times that after Liz Trusses debacle even after it was quickly reversed. |

|

Steve

Hero Protagonist

Posts: 3,633

|

Post by Steve on Nov 2, 2024 11:03:06 GMT

Ahem: 'Skipton Building Society and Coventry Building Society have both announced rate increases from next week as jittery lenders readjusted their prices in the wake of Wednesday’s announcement.

Virgin Money was the first to increase rates by up to 0.15pc, while Santander said it would cut residential and buy-to-let fixed rates by up to 0.36pc. Halifax has raised some rates and cut others.'www.telegraph.co.uk/money/property/mortgages/lenders-raise-mortgage-rates-budget-market-jitters/ other sources available |

|

|

|

Post by Zany on Nov 2, 2024 11:15:39 GMT

Ahem: 'Skipton Building Society and Coventry Building Society have both announced rate increases from next week as jittery lenders readjusted their prices in the wake of Wednesday’s announcement.

Virgin Money was the first to increase rates by up to 0.15pc, while Santander said it would cut residential and buy-to-let fixed rates by up to 0.36pc. Halifax has raised some rates and cut others.'www.telegraph.co.uk/money/property/mortgages/lenders-raise-mortgage-rates-budget-market-jitters/ other sources available The BofE will not announce the new rate until the 10th of November. I do not believe a few examples of 0.15% represent the market, nor much effect what people are currently paying. 0.15% would add about £1.50 a month to the average mortgage. |

|

Steve

Hero Protagonist

Posts: 3,633

|

Post by Steve on Nov 2, 2024 11:17:17 GMT

The BoE does not announce mortgage rates, the building societies and banks do. And one of the biggest immediately raised its rates, fact.

|

|

|

|

Post by equivocal on Nov 2, 2024 11:34:26 GMT

I don't think there is much doubt that if gilt yields are higher, then morthage rates will be higher. Similarly, if the private market has to pick up something north of 10% more in gilts over the next couple of years, then gilt yields will be higher.

|

|

|

|

Post by Zany on Nov 2, 2024 12:34:28 GMT

The BoE does not announce mortgage rates, the building societies and banks do. And one of the biggest immediately raised its rates, fact. Apologies, I thought you might be able to join the dots. The BofE announce interest rates the Banks and Building societies base their mortgage rates on this. I will endeavour to keep my sentences as long as possible in the future, so as not to confuse you. The biggest one raised its rate by 0.15% Ooooh. Lets see what the Bof E do. |

|

Steve

Hero Protagonist

Posts: 3,633

|

Post by Steve on Nov 2, 2024 13:39:54 GMT

I'll remind you what you actually posted Mortgage rates have not risen. . . |

|

|

|

Post by Zany on Nov 2, 2024 13:50:53 GMT

I'll remind you what you actually posted Mortgage rates have not risen. . . Overall they haven't. When you posted most headlines said Mortgages may rise. Only GB News claimed they actually had. I'll leave it there. |

|