|

|

Post by brownlow on Aug 26, 2024 15:35:14 GMT

OK then our debt to GDP is at massive peacetime levels. Our debt is over 5 times what it was in 2007 After WW2 we had Marshall Aid and still had to keep going to the IMF for bailouts. Anyone that likes our social policies really doesn't want to have to go to the IMF again because they'll demand we cut them. And yes Greece is different. It had and has the EU and Euro clubs to help it. We don't have either. This has mostly been addressed. If anyone else thinks other central banks can't do what the ECB did, I can point them to evidence that they're mistaken. If anyone else thinks countries borrow their own currencies from the IMF, or that UK debt is in a currency other than its own, I can point them to evidence that they're mistaken.

Most OECD debt to GDP ratios have been at high-ish peacetime levels following the Great Recession, then the pandemic. And similar to Greece's in 2009. So where are all the Greek-style debt crises?

Speaking of debt in 2007 and the crash, what was private debt in 2007? Why, it was at a record high. By 2007, just before the crash, private debt reached nearly 200% of GDP:

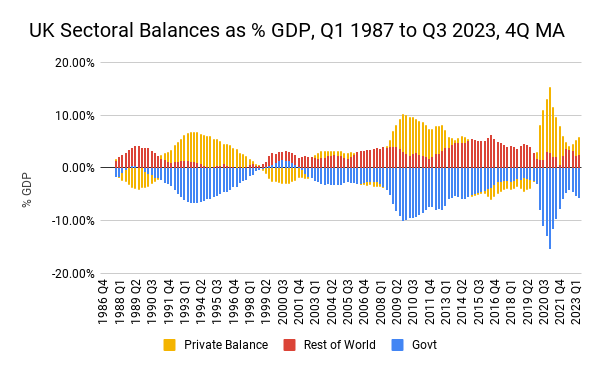

"It is not possible to have a negative external balance, as the UK does, with concurrent surpluses in the public, household and corporate sectors. If the UK is a net borrower from the rest of the world because of its current account deficit, then somewhere in the domestic economy must be a balancing deficit.

The net saving of corporates and foreigners during the pre-crisis years was balanced both by a public sector deficit and by a growing deficit in the household sector (blue line). We now know that the household deficit was associated with unsustainable credit growth. When the crash came, households switched abruptly from deficit to surplus. Foreigners, corporates and households were all net saving at the same time. As I said, the sectoral balances have to sum to zero: so the increase in the government deficit balanced the desire of all three private sectors to save at the same time. When no-one wants to spend, someone must, and that someone is inevitably government. Government is the "spender of last resort".

The trouble is that when everyone is saving like crazy (including paying down debt, which economically is equivalent to saving) people get very worried indeed at the sight of apparently out-of-control government deficit spending, failing to see the relationship of that spending to their own saving behaviour. So governments then embark on austerity programmes to shrink the deficit. The result of this (assuming no fall in GDP) is that deficit spending moves around. The public sector deficit is shifted back to the private sector."

|

|

|

|

Post by brownlow on Aug 26, 2024 15:45:23 GMT

Worth remembering how interest rates climbed big time the last time a government announced plans to spend even more money it wasn't going to be able to take in We have run out of ability to fund more wishlists from increasing borrowing or printing  I doubt it since very little additional borrowing was announced in the September mini budget - about £11B (0.5% of GDP) of additional tax cuts - dwarfed by the £100B energy package which had already been announced without causing a panic. So why did bond yields spike immediately afterwards? Because, the day before, the BoE had announced a ton of QT (selling bonds bought in QE back into the market). That meant that bond yields would rise (prices fall), which caused a cascade of margin calls and sell-offs, particularly among LDI funds which had emerged during the ultra-low interest rates era. The BoE had been warned, but went ahead anyway. On top of that, it appeared that the UK govt and central bank were pulling in opposite directions - the govt trying to inject money, and the BoE trying to pull it out. Note that the BoE stabilised bond prices, simply by committing to buy them at a price floor. It didn't even have to buy (many) bonds. Later, when it withdrew the commitment and announced more QT, up went bond yields again. By then the Truss tax cuts had been scrapped and never implemented. As stupid as the mini-budget was, it was a sideshow. |

|

Steve

Hero Protagonist

Posts: 3,698

|

Post by Steve on Aug 26, 2024 17:15:59 GMT

So you're saying that interest rate leap was nothing to do with the increased borrowing in that infamous mini budget. I suggest the correlation is so high it's irrefutable as all the observers of provenance said at the time. Private debt did indeed start the 2007 slide but not because it was unpayable but because households in effect stopped taking on more household debt triggering all sorts of vicious circle issues including a fall in GDP and especially taxable GDP which meant an increase in the deficit even before the money printing. Private debt is currently at 161% of GDP. Not a comfortable figure, nor is the household debt component of it at 80%. Arguably the real figure to worry about is household debt to disposable income which is very subject to any mortgage rate rises triggered by an increased deficit budget. commonslibrary.parliament.uk/research-briefings/sn02885/ |

|

|

|

Post by brownlow on Aug 26, 2024 19:39:46 GMT

So you're saying that interest rate leap was nothing to do with the increased borrowing in that infamous mini budget. I suggest the correlation is so high it's irrefutable as all the observers of provenance said at the time. Private debt did indeed start the 2007 slide but not because it was unpayable but because households in effect stopped taking on more household debt triggering all sorts of vicious circle issues including a fall in GDP and especially taxable GDP which meant an increase in the deficit even before the money printing. Private debt is currently at 161% of GDP. Not a comfortable figure, nor is the household debt component of it at 80%. Arguably the real figure to worry about is household debt to disposable income which is very subject to any mortgage rate rises triggered by an increased deficit budget. commonslibrary.parliament.uk/research-briefings/sn02885/ The "correlation" cock-up was cutting taxes at the same time as the BoE was tightening. Mortgage costs rising when central banks tighten is exactly what's supposed to happen. Govt borrowing costs (treasury bond yields) and interest rates which affect mortgages are different things. They're both affected by monetary policy, but govt borrowing doesn't make your mortgage go up (as some journalists seem to imagine) unless it causes inflation, causing the central bank to tighten. Govts have borrowed huge sums while central banks have held interest rates near zero.

The rest of what you've written is still missing the point that the less the govt is in debt, the more we are.

|

|

Steve

Hero Protagonist

Posts: 3,698

|

Post by Steve on Aug 26, 2024 21:11:23 GMT

We'll have to disagree. To me it's just unlikely that interest rates don't go up when someone already is borrowing massive amounts of money and wants to increase that even more. It becomes a sellers (of loans) market and risk averseness comes into play too.

And most experts seem to back me.

|

|

|

|

Post by brownlow on Aug 27, 2024 15:33:34 GMT

We'll have to disagree. To me it's just unlikely that interest rates don't go up when someone already is borrowing massive amounts of money and wants to increase that even more. It becomes a sellers (of loans) market and risk averseness comes into play too. And most experts seem to back me. If so, they're patently mistaken. During the time govt debt went up and up (as you repeatedly point out), interest rates went down and down, eventually to record lows.

Nor would the inverse relation of govt and private debt hold, but it does:  Like most folks and a lot of journalists, you think the govt "borrows" in order to spend - like a household. Not so. The govt issues treasury bonds because it has net spent. It has spent by instructing its central bank to credit (not debit) banks' reserve balances. Increased reserve balances mean banks can offer cheaper credit, e.g. mortgages. If nothing else happened, reserves would accumulate in the banking system until their value in the interbank market was driven to zero. That's why the govt matches its deficit with treasury bond sales. When a bank, or a bank's client, buys a treasury bond, that bank's reserve account is debited by the value of the bond. If the central bank wants the banks to offer cheaper credit, it buys the bonds back, re-topping up their reserve balances. |

|

Steve

Hero Protagonist

Posts: 3,698

|

Post by Steve on Aug 27, 2024 15:53:54 GMT

|

|

|

|

Post by dappy on Aug 27, 2024 16:03:30 GMT

I haven’t followed this discussion in full.

Brownlow if I understand you correctly, your argument is that governments can borrow unlimited amounts without adverse consequence. If I have understood you correctly, does that mean that all taxation can be abandoned and the government can fund any spending it desires from “borrowing”

If I have not understood you correctly, could you clarify your point.

|

|

|

|

Post by brownlow on Aug 27, 2024 21:09:23 GMT

"Essentially," yes - unless he means the govt would otherwise simply run out of £s. Which he doesn't actually say, few would agree with, and is empirically falsifiable. More specifically, the government borrows, i.e. issues treasury bonds, so that it can spend more than it taxes without causing a financial crisis, as I explained. Among other reasons |

|

|

|

Post by brownlow on Aug 27, 2024 21:15:15 GMT

I haven’t followed this discussion in full. Brownlow if I understand you correctly, your argument is that governments can borrow unlimited amounts without adverse consequence. If I have understood you correctly, does that mean that all taxation can be abandoned and the government can fund any spending it desires from “borrowing” If I have not understood you correctly, could you clarify your point. No, you haven't understood correctly. No one says that AFAIK. The govt can buy anything for sale in its own currency. But if it keeps spending beyond Potential GDP, it will cause inflation and, eventually, currency collapse. I do, however, I agree with economists who argue that we're lagging Potential GDP - nearly 2 decades of lowest growth on record - because of artificial fiscal rules. So I disagree with assertions in this thread that govt should maintain a fiscal surplus, or try to. |

|